As you know, all data within the Blockchain network is public and transparent, which is why many crypto investors often analyze data on the Blockchain to gain an overview of the entire market and assess upcoming trends. This information is referred to as On-chain data, but what exactly is On-chain data? Let's find out in this article.

I. What is On-chain Data?

On-chain data comprises all data recorded on the Blockchain. This data can include:

- Transaction data: Wallet addresses, transfer amounts, tokens transferred, etc.

- Block data: Time, gas fees, miner, etc.

- Interactions with Smart Contracts: Add liquidity, governance participation, etc.

Whenever a user performs an action on the Blockchain network, that action is immediately verified by nodes and updated onto the overall Blockchain network.

Moreover, because Blockchains are decentralized networks running on numerous Nodes—Bitcoin has up to 11,558 nodes, Ethereum has over 8,000 nodes—data is widely shared and cannot be manipulated or altered. For this reason, On-chain data is the most accurate and transparent available.

II. Why Analyze On-chain Data?

Recently, just a few tweets from billionaire Elon Musk have stirred the market, or misleading technical analyses and news intentionally spread by whales to confuse investors, leading to wrong decisions. To verify the correctness of such information, it is necessary to analyze On-chain data. Through On-chain data, investors can reap the following benefits:

- Accurate information: On-chain data provides investors with the most accurate information about the activities happening on the Blockchain, and since this data is hard to manipulate, it's the most reliable source in the market.

- Monitor market behaviors in real-time: On-chain data helps track the behavior of whales, the ones capable of manipulating the market, so investors can make more informed decisions in the crypto market.

- Help forecast and make investment decisions: Activities on the network often precede information on media channels, so if investors regularly update On-chain data, they can anticipate situations and find appropriate solutions. For example, if the market is undergoing a strong correction, but the large whale wallets continue to accumulate without showing signs of selling, an investor might opt to buy rather than sell.

For DeFi platforms, investors can rely on On-chain data of the product such as the number of holders on a Dapp's contract and its transaction volume to decide whether to engage or not.

III. Considerations When Analyzing On-chain Data

As mentioned, analyzing On-chain data brings many benefits to crypto investors, but there are some points to bear in mind:

- Requires fundamental knowledge and experience: Successful On-chain analysis demands a solid foundation of knowledge and diverse perspectives to accurately evaluate and forecast from On-chain data.

- Consult various information sources: Currently, many different tools provide On-chain data of varying accuracy. It's important to compare and cross-reference information from various sources for the most accurate assessment.

- Thoroughly check the data on the project's website: Sometimes the information some projects provide on their websites might not be entirely accurate, so double-check that information on the Blockchain Explorer of that Dapp's platform.

- Regularly monitor On-chain data: Since market behaviors are constantly changing, information also needs to be updated regularly for swift action.

IV. Tools for Analyzing On-chain Data

There are many tools for analyzing On-chain data, here are some with relatively high accuracy that investors should use:

- Whalebot Alert: A Telegram channel that alerts when whales are active so investors can know the addresses of large whales and monitor their portfolios to buy/sell accordingly.

- CoinMetrics: Provides free data on 37 different cryptocurrencies, including indexes and on-chain correlations.

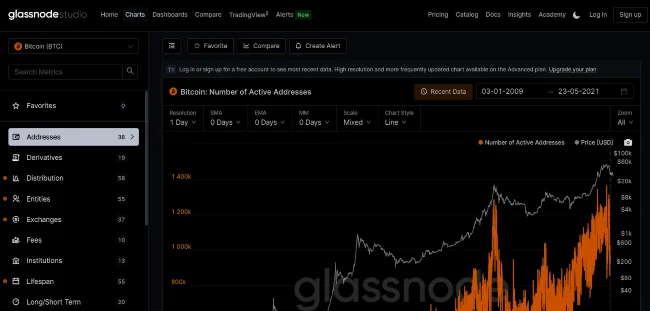

- Glassnode: Allows free access to basic On-chain indices. To receive more in-depth reports and use more advanced features, a small fee is required.

- Crypto Quant: Commonly used for analyzing On-chain data for BTC or ETH. Crypto Quant offers comprehensive data from BTC exchange inflow information to in-depth On-chain indicators.

- Look Into Bitcoin: Visualizes Bitcoin market cycles and on-chain indicators.

- IntoTheBlock: Offers a variety of analytical tools, including on-chain analysis for many cryptos, order book data, and sentiment analysis methods.

- The Block: Under the Data section, investors can access a wide range of data such as Spot and Future trading volume, as well as information about Bitcoin and Ethereum moving in and out of exchanges. It also provides info on which Blockchain a Stablecoin resides, and more.

Additionally, there are many other On-chain analysis tools such as Token Terminal, Nansen, Dune Analytics, etc., which you can explore further.

Submit feedback

Your email address will not be made public. Fields marked are required *

Search

Trend

-

The most commonly used HTML tags

02-01-2020 . 11k view

-

Websites for earning money at home by typing documents

05-17-2023 . 9k view

-

Earn money by answering surveys with Toluna

01-12-2020 . 7k view

-

Guide to creating a database in phpMyAdmin XAMPP

04-25-2020 . 4k view

0 feedback